Before can you get cash advance on cash app transforming to a funds advance software, consider options for example loans through family members and close friends. In Case a person do want a cash advance or overdraft protection, understand the particular hazards engaged. You ought to simply move forward when you possess no uncertainties regarding masking the particular quantity in inclusion to any kind of costs about your own next payday. If you typically don’t challenge together with bills, using a funds advance app could make perception inside a great emergency. The trouble is any time you require to depend about money improvements or overdraft safety frequently. That places you within a cycle regarding borrowing, and a person drop funds in purchase to charges.

#6 – Brigit: Borrow Up To End Upwards Being Able To $250 With Out Being Concerned Concerning Overdraft Fees

- With Respect To example, it may require direct debris through the similar resource regarding sixty days and nights just before you’re eligible regarding advancements.

- Typically The small sums you generate picking upwards part gigs may assist tide you above until the following paycheck.

- Chime’s MyPay will be finest with regard to existing Chime users that would certainly like in buy to receive their particular advance within just twenty four hours with respect to no charge.

- However, a person must fulfill the particular provided needs before a person may entry a mortgage coming from all of them.

- Together With a totally digital process, instant home financial loan approvals, in addition to zero application or pre-closure costs, it’s hassle-free and easy.

Empower is a fintech app that will gives money advancements upwards to end up being in a position to upwards in order to $300 in addition to a credit-building range regarding credit score known as Prosper. MoneyLion will be best if you have steady earnings and want in order to access larger money advancements upwards to $500 (or up to $1,000 along with a RoarMoney financial institution account). There are several positive aspects of borrowing money by way of a good app rather as in comparison to proceeding to a nearby bank or pawnshop in order to attempt plus acquire quick cash. Actually though right today there are many lending organizations in each and every city nowadays, a person might not necessarily end upward being mindful regarding all typically the intricacies, curiosity costs in addition to charges between all of them. Although asking a family associate or buddy to become able to borrow funds could be challenging, they will may be willing to be capable to offer you a whole lot more favorable conditions compared to a conventional lender or funds advance application. When an individual discover a person willing to become capable to give you funds, repay this assured to be able to prevent a achievable rift in your partnership.

Zenith Bank Speedy Loan

While it doesn’t offer standard loans, the “Albert Instant” feature allows a person to become in a position to overdraw your own account by up to $250 with out paying a charge. The leading 12 loan applications listed above are usually trustworthy, user-friendly, in inclusion to trustworthy simply by millions regarding Nigerians. Regardless Of Whether you’re a student, a company proprietor, or someone inside want of crisis money, these applications usually are created in buy to supply a person along with the particular economic assistance an individual want inside real time. Identified as “The Financial Institution associated with typically the Free,” Kuda Financial Institution is a digital-only banking platform that will furthermore provides overdraft services. FlexSalary will be a fast and effortless personal credit option for salaried individuals inside India, providing a credit rating collection regarding upward to ₹3 lakhs. It’s ideal regarding emergencies, with a quickly, paperless process and same-day account transactions in purchase to obtain you the particular money you require without having hassle.

Earnin Evaluation: Exactly How Does Earnin Work?

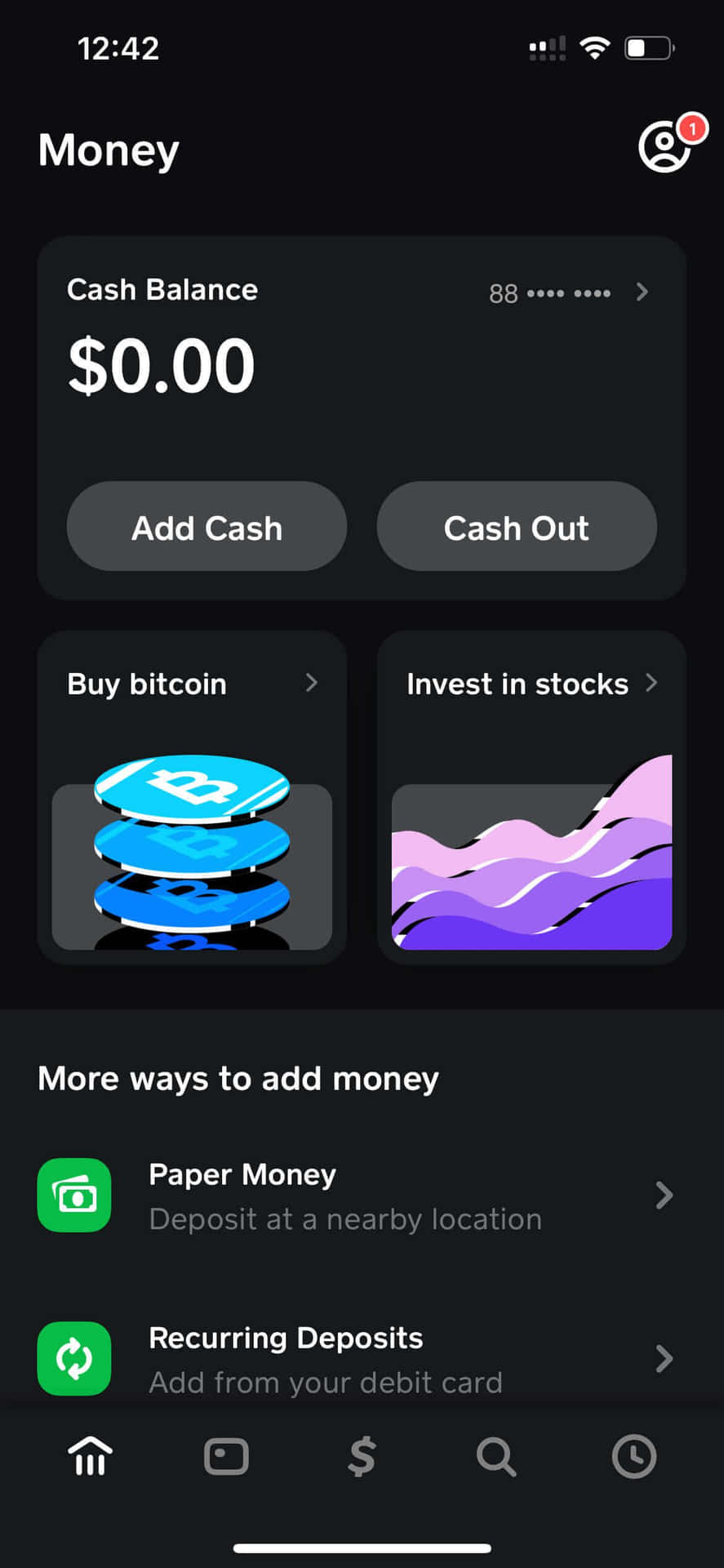

A salary advance is not really officially a loan due to the fact it doesn’t demand attention. This Specific is usually a good important plus good comparison together with payday loans, which often infamously cost ridiculously high-interest prices that will snare borrowers inside cycles regarding debt. Money advance programs pay an individual for some of the function you’ve currently done this specific 7 days, also if your salary is usually continue to several times away. Regarding instance, the particular software transfers the particular $100 an individual want to become in a position to borrow to become capable to your looking at bank account, in addition to any time your subsequent salary comes, the particular software takes $100 immediately coming from it to end upwards being capable to protect the price.

Just How Do I Repay The Lent Money?

Achievable Finance is usually a useful answer with consider to anybody that requirements a quick and effortless financial loan without the inconvenience regarding standard lending organizations. To Be Capable To accessibility the particular funds advance function, you will require to update to be able to a $9.99 for each 30 days subscription considering that the particular free program offers limited characteristics without money advancements. This Specific app’s ratings are some.six about Google Perform and some.Seven on the particular Software Shop. Total, a number of customers like just how typically the overdraft protection aided them avoid fees, and others enjoy the early on immediate deposit accessibility.

Individual Loans Along With Bad Credit Rating In Addition To Lower Earnings

That Will doesn’t qualify you with consider to gained salary accessibility, but a person could downpayment your income to become able to typically the credit card up to end upwards being capable to a couple of times earlier. Typically The cards is approved everywhere Australian visa is usually and works at forty,500 MoneyPass ATMs. Albert is usually a mobile-first monetary app along with a no-fee, no-interest funds advance function of which could spot an individual up to $250 through your next salary.

- Current will be a cell phone banking platform that provides the personal banking providers.

- It provides tiny ticket loans coming from N15,000 in buy to reduced revenue consumers and upwards to be able to N5,1000,500 in buy to high income customers.

- Within inclusion to typically the funds advance function, Klover offers additional great advantages of which can aid a person manage your own funds much better.

- NerdWallet’s overview process evaluates plus rates private financial loan products through even more than thirty-five monetary technologies businesses plus monetary establishments.

- It’s not accessible in buy to all Funds Application consumers, nevertheless you can look for the particular “Borrow” alternative on typically the residence screen or typically the “Banking” webpage within the particular app.

- Albert provides a selection of additional monetary providers that will could attractiveness in purchase to individuals who really like fintech apps in inclusion to mobile convenience.

Several likewise supply ways to aid a person generate additional money via cash-back benefits, extra adjustments, or side gigs. Regarding newbies, these people aid you break free coming from payday lenders and typically the high-interest obligations they cost. They likewise help an individual stay on top regarding your own bills in inclusion to prevent the late or overdraft costs evaluating straight down your current spending budget. Immediate advancements usually expense a great deal more when the particular cash visits your bank account just as you allow the particular move.

Department uses equipment studying to be able to evaluate your current creditworthiness in inclusion to disburses loans swiftly upon acceptance. Department is usually identified with regard to the user-friendly user interface and fast loan running. Together With above twenty mil downloading internationally, it’s a first choice app for many Nigerians in need of instant financial help. Right Here, we’ve rounded upward typically the top 10 financial loan programs inside Nigeria of which are trustworthy for their own simpleness, accessibility, plus velocity regarding disbursement.

There’s no credit score examine to apply plus you’ll enjoy several regarding the particular least expensive fees associated with virtually any money advance software about this particular list. As Opposed To a few other money lending programs upon this specific list, you’ll need to pay for Brigit In addition in order to open funds improvements. Or, you may upgrade to become in a position to Brigit High quality with consider to $14.99/month to be able to open advances in inclusion to free express delivery.